The smart Trick of Nj Cash Buyers That Nobody is Discussing

Table of ContentsThe smart Trick of Nj Cash Buyers That Nobody is DiscussingRumored Buzz on Nj Cash BuyersEverything about Nj Cash BuyersExamine This Report about Nj Cash Buyers

A lot of states give consumers a particular level of protection from lenders concerning their home. Some states, such as Florida, totally exempt your house from the reach of specific lenders. Various other states set restrictions varying from as little as $5,000 to as much as $550,000. "That indicates, no matter of the worth of your house, financial institutions can not compel its sale to please their insurance claims," says Semrad.You can still enter into foreclosure through a tax obligation lien. If you fall short to pay your property, state, or government tax obligations, you might shed your home through a tax obligation lien. Getting a house is a lot easier with cash money. You do not have to wait for an examination, assessment, or underwriting.

(https://zenwriting.net/njcashbuyers1/nj-cash-buyers)I understand that several sellers are much more most likely to approve an offer of cash money, but the seller will get the money regardless of whether it is financed or all-cash.

Getting My Nj Cash Buyers To Work

Today, about 30% of US buyers pay money for their residential properties. That's still in the minority. There might be some excellent factors not to pay cash. If you simply have enough cash money to spend for a residence, you might not have any kind of left over for repair services or emergency situations. If you have the money, it could be an excellent concept to set it apart to ensure that you contend least three months of housing and living costs must something unforeseen take place was shedding a task or having medical problems.

You could have qualifications for an excellent mortgage. According to a current research study by Cash magazine, Generation X and millennials are considered to be populations with one of the most possible for development as customers. Taking on a little bit of financial debt, particularly for tax obligation objectives wonderful terms could be a far better option for your finances in general.

Possibly purchasing the securities market, mutual funds or an individual business could be a far better choice for you over time. By buying a building with cash money, you risk diminishing your book funds, leaving you susceptible to unexpected upkeep expenses. Possessing a home involves continuous prices, and without a home mortgage pillow, unforeseen repair work or renovations might stress your finances and hinder your capability to preserve the home's problem.

Some Known Questions About Nj Cash Buyers.

Home rates fluctuate with the economy so unless you're intending on hanging onto your home for 10 to 30 years, you may be much better off investing that money elsewhere. Buying a building with cash money can speed up the purchasing process considerably. Without the requirement for a home mortgage authorization and connected paperwork, the transaction can close quicker, offering an affordable side in competitive genuine estate markets where vendors might like money purchasers.

This can cause substantial cost savings over the long-term, as you will not be paying passion on the funding amount. Cash money purchasers frequently have stronger settlement power when taking care of vendors. A money offer is a lot more appealing to sellers considering that it minimizes the danger of an offer failing because of mortgage-related concerns.

Bear in mind, there is no one-size-fits-all solution; it's important to customize your choice based upon your specific conditions and lasting ambitions. All set to start checking out homes? Give me a telephone call anytime.

Whether you're selling off assets for a financial investment residential property or are carefully saving to purchase your desire residence, getting a home in all money can substantially raise your acquiring power. It's a strategic move that enhances your setting as a purchaser and enhances your adaptability in the property market. It can place you in a monetarily vulnerable place.

How Nj Cash Buyers can Save You Time, Stress, and Money.

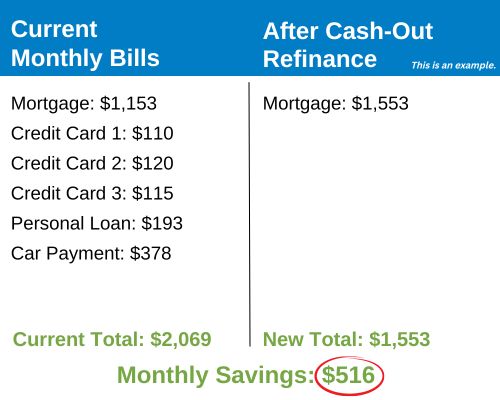

Reducing passion is among one of the most common reasons to buy a home in money. Throughout a 30-year mortgage, you could pay tens of thousands or also hundreds of countless bucks in overall rate of interest. Furthermore, your purchasing power raises with no financing backups, you can explore a wider option of homes.

The greatest danger of paying money for a home is that it can make your finances unstable. Locking up your liquid possessions in a property can decrease financial adaptability and make it extra difficult to cover unanticipated costs. Furthermore, tying up your cash suggests losing out on high-earning financial investment possibilities that can generate higher returns somewhere else.